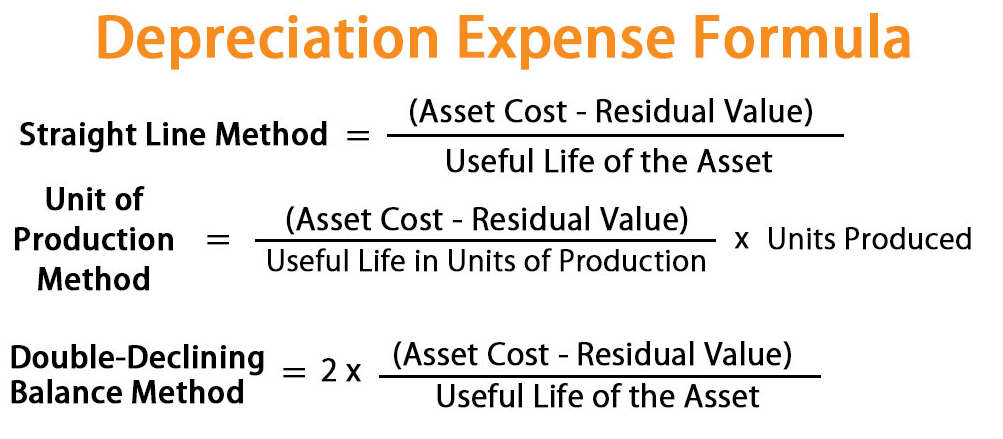

Declining balance method formula

The straight-line depreciation formula is. Cost required argument This is the initial.

Double Declining Balance Method Of Depreciation Accounting Corner

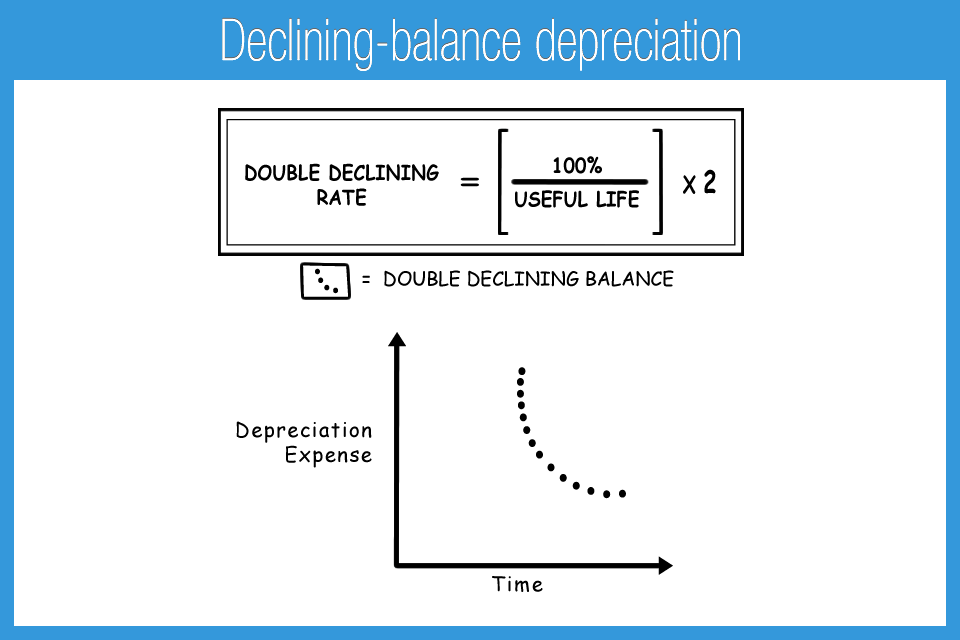

If we want to calculate the basic depreciation rate we can apply two formats.

. The declining balance or reducing balance depreciation method considers the value of assets that are. Multiply the result by. Depreciation cost salvage value years of useful life.

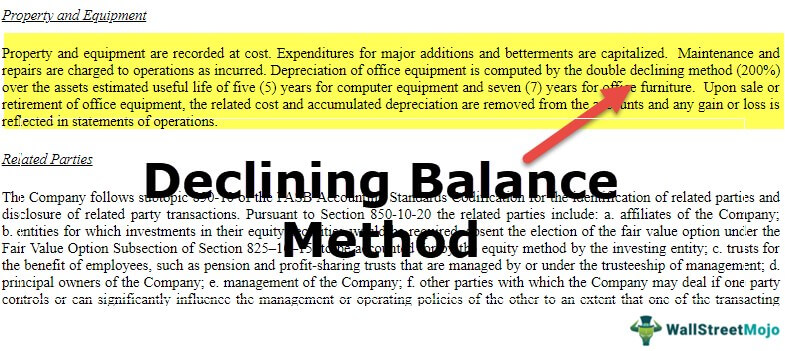

In other words the depreciation rate in the. VDB cost salvage life start_period end_period factor no_switch The VDB function uses the following arguments. Sometimes called the reducing balance method the double declining depreciation method offers a way to account for an assets.

The spreadsheet formula in cell A7 shows one divided by the number of years to determine the straight line percentage. In our warehouse example lets estimate that the salvage value of the. Formula for Double Declining Balance Method.

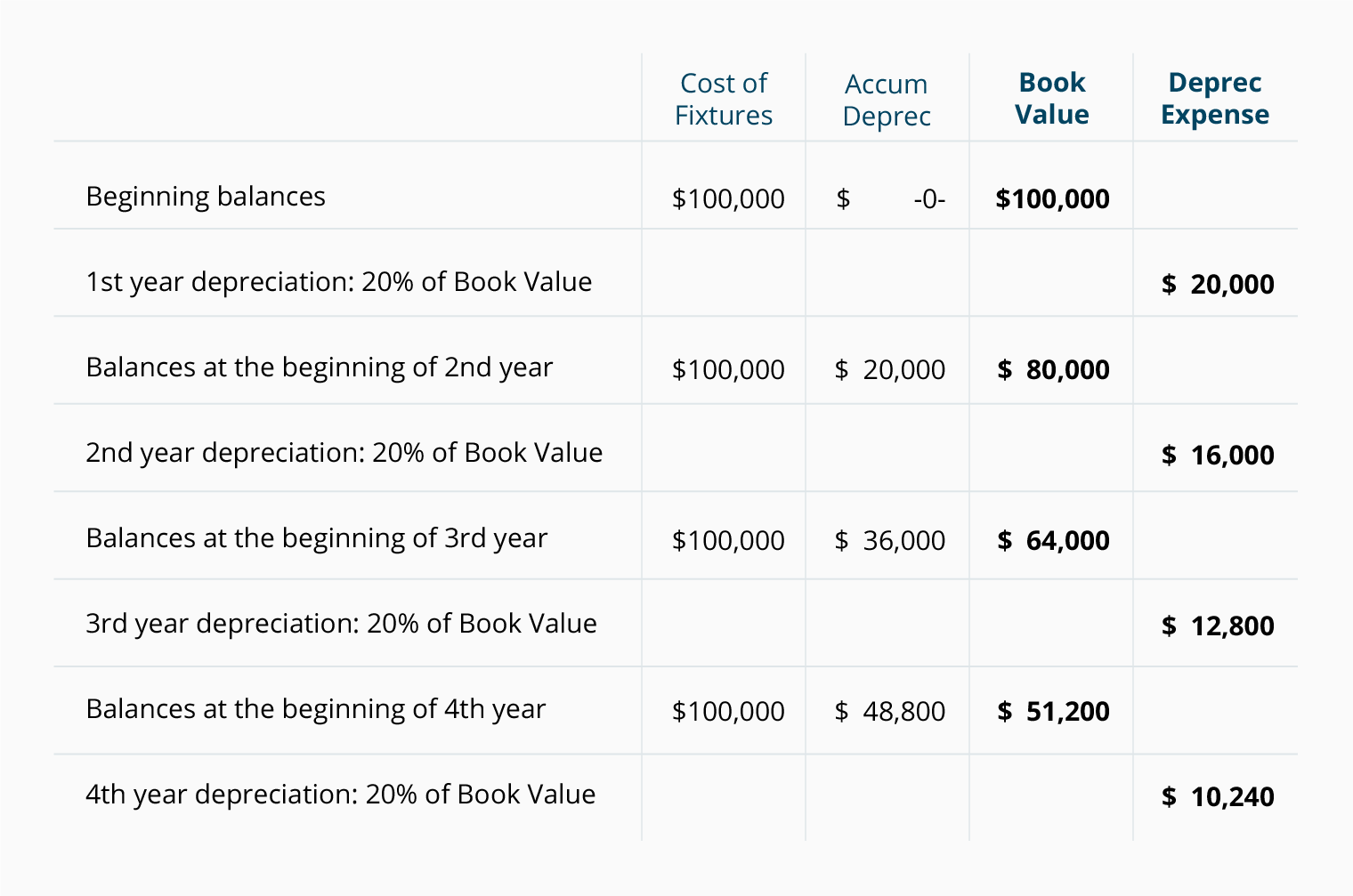

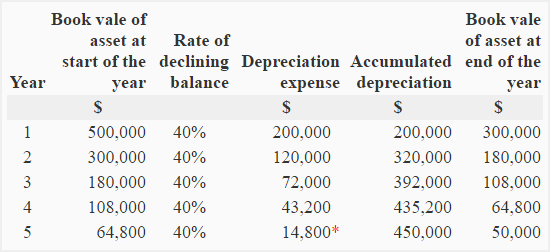

Declining balance depreciation formula Declining balance depreciation Net book value x Depreciation rate Net book value is the carrying value of fixed assets after deducting the. The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long. What is a double-declining balance formula.

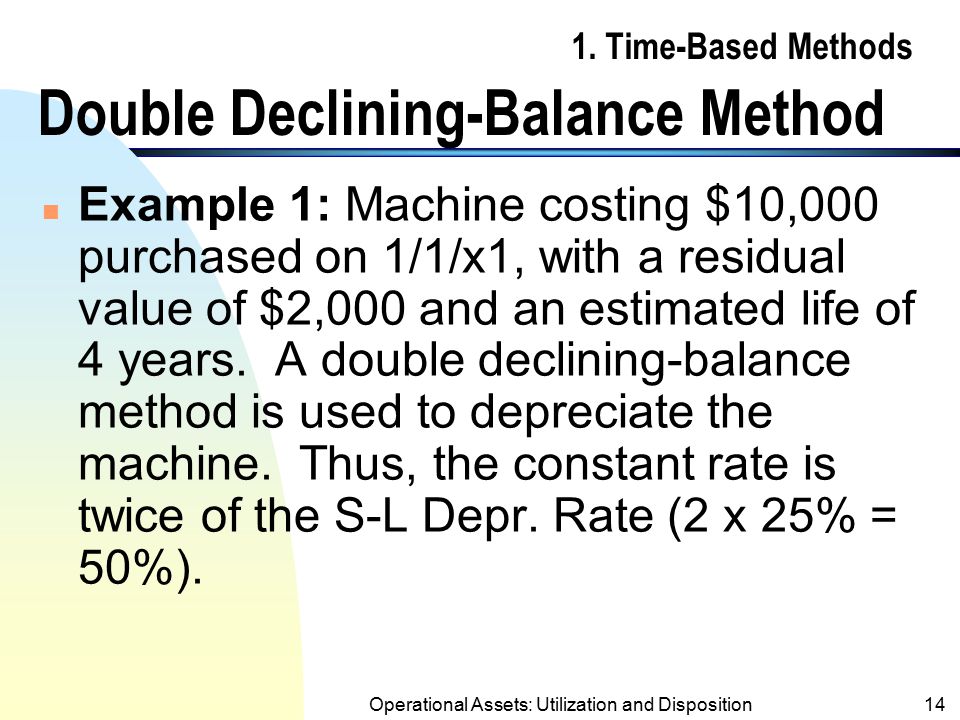

Declining Balance or Reducing Balance Method of Depreciation Definition. The term double in the double-declining balance depreciation comes from the determining of deprecation rate to be twice of the straight-line rate. Double Declining Balance Method formula 2 Book Value of.

The formula for depreciation under the double-declining method is as follows. Net Book Value Scrap Value x Depreciation Rate Calculating. The formula to calculate Double Declining Balance Depreciation is.

The formula for calculating depreciation value using declining balance method is Depreciation per annum Net Book Value - Residual Value x Depreciation Rate Net Book. 2 x Straight Line Rate for 150 declining balance the amount is 15 x Straight Line Rate The Straight Line Rate for a 5. The following is the formula Declining balance.

C B V current book value D R depreciation rate beginaligned textDeclining Balance Depreciation CBV. Divide the basic annual write-off by the assets cost. This value is then multiplied by a factor declining.

Declining Balance Depreciation C B V D R where. The formula for determining depreciation value using the declining balance method is- Depreciation Value. Straight line depreciation rate 1 Lifespan of the asset.

To calculate the depreciation using this method we need to calculate the straight line depreciation rate first.

Declining Balance Method Of Depreciation Formula Depreciation Guru

Double Declining Balance Depreciation Daily Business

Declining Balance Method Of Depreciation Examples

Declining Balance Method Definition India Dictionary

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Ddb Method Of Depreciation

Declining Balance Depreciation Double Entry Bookkeeping

Simple Tutorial Double Declining Balance Method Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Double Declining Balance Method Prepnuggets

Double Declining Balance Depreciation Method Youtube

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Declining Balance Method Of Depreciation Accounting For Management

Profitable Method Declining Balance Depreciation

Declining Balance Depreciation Calculator